This is an automated archive made by the Lemmit Bot.

The original was posted on /r/Superstonk by /u/xbmaxxx on 2025-01-27 08:15:40+00:00.

Given all the uncertainty of the carry trade impact on GME and beyond this week, wanted to bring up some old and relevant DD related to some recent findings. Barely having a wrinkle myself, I thought this was interesting, so thought I’d also share for you new smooth brains just in case you’re not completely vegetable.

-

We recently learned about the DTCC’s Ireland repository representing over 100+ quintillion in OTC derivative value. Yes, quintillion. Whatever that means:

-

In that discussion, you dumb apes showed lots of love to this comment of mine:

“Am merely smooth brained Jan 2021 OG ape, but, have earned a wrinkle or two. I think this is significant because all those OTC (dark pool) trades which drive the massive volume (likely fake volume fueled by ETF abuse to manipulate price) end up as FTDs on someone’s books. This sub has talked about in the past DTCC’s obligation warehouse, but as we all know, SHF and their conspirators really don’t like blemishes on their books/balance sheets. Could Ireland be where the bodies/FTDs are buried? Need a more wrinkly brained ape to expand/poke holes in this theory. Not financial advice. Am ape with computer on the internet. Do not listen to me.”

- Tonight I saw this post by Kristen Shaughnessy (all credit to @kshaughnessy2) on Feb 2nd, 2024 referencing a video with a CEO named Jon Brda:

"Listen to the video below.

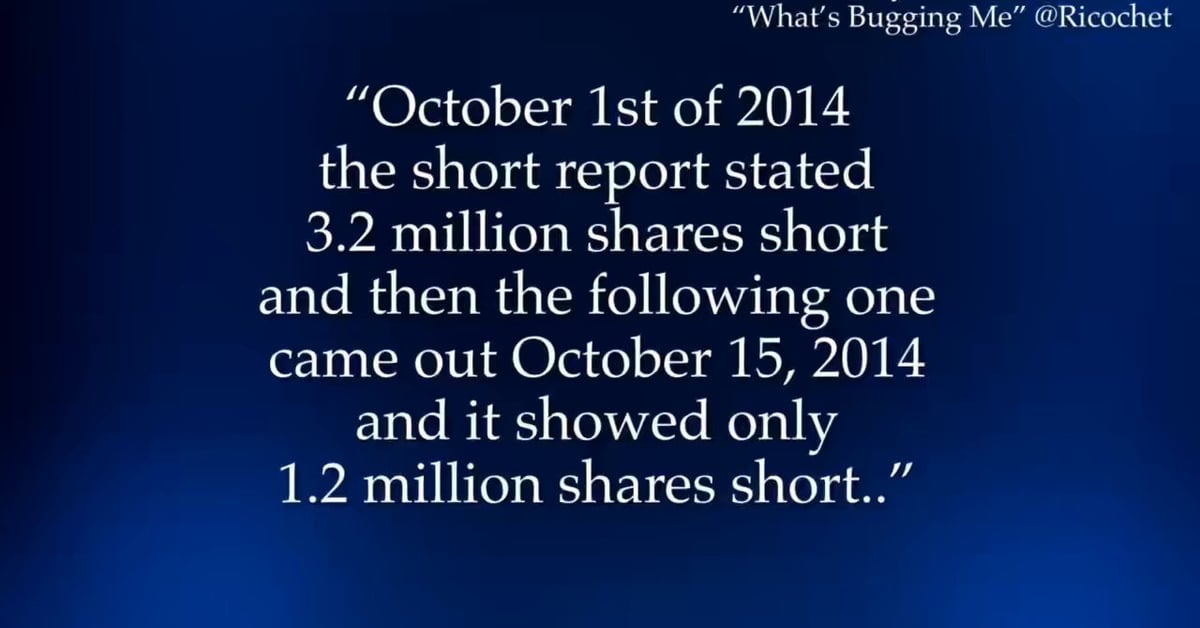

@johnbrda explains how FINRA makes short positions disappear. Also read his tweet below.

…they called me back a couple days later and said FINRA told us that two million shares that were short moved offshore and therefore they are out of the U.S. purview so they don’t count them as short anymore. I said ‘well that’s the most insane thing I’ve ever heard in my life. Why would they not treat them as a short position when they know full well what happened to them?’ And she couldn’t explain it to me because she was the one saying that every single share is always accounted for.

Well this is hard core evidence that is absolutely not the truth

@johnbrda"

- Being as smooth as I am, even since Jan 2021, I remembered that name. His name was John Brda. So like any 🙌💎🦍, I just kept mashing the search button on our mountain of DD. Lo and behold this thick, wrinkly stud of a post from three years ago (wish reddit showed actual posting dates, so assuming sometime in 22):

“How shorts disappear directly from the horses mouth.”

That bulging post features a now-dead link to a Twitter spaces discussion that included John Brda. That wrinkly ape OP recalled:

“Early on there was discussion about short positions being moved offshore. We also have the Brazilian puts for GME. This ties right into that. We also hear John saying that NASDAQ is completely unable to track these offshore short shares that were moved.”

- Assuming that post was in 22, in the comments you regards saw the writing on the wall about CS’s then yet-to-happen implosion arising from the Brazillian puts (Archegos’ puts, right? Please correct me if wrong):

[Haywood_jablowmeeee]:"They were immediately moved to Credit Susie’s after they were found…. "

[deleted]: “Funny, now they’re insolvent”

Then a year later…

“On 27 June 2023, UBS announced its intention to cut more than half of Credit Suisse’s workforce. In July 2024, Credit Suisse (Schweiz) ceased to exist as a separate legal entity after fully being integrated into UBS Switzerland.”

So here’s my question resulting from all these connections about offshoring:

Was Credit Suisse the canary in the coal mine for a toxic position so bad, so nasty, and so much smaller than the amounts represented by DTCC Ireland repository? Presumably, some unknown percentage of those absurd numbers also represent fatally fucked positions held by some as-yet-to-fail others. And if so, r shorts fuk’d?

Not financial advice. Not quant. Am ape with computer on internet. Just making connections and showing big ape balls. Do not listen to me.